Table of Contents

How to Ramp Up a Credit Score? Answering the Most Frequent Questions

How is Your Credit Score Defined? A Guide to the FICO Credit Rating Model

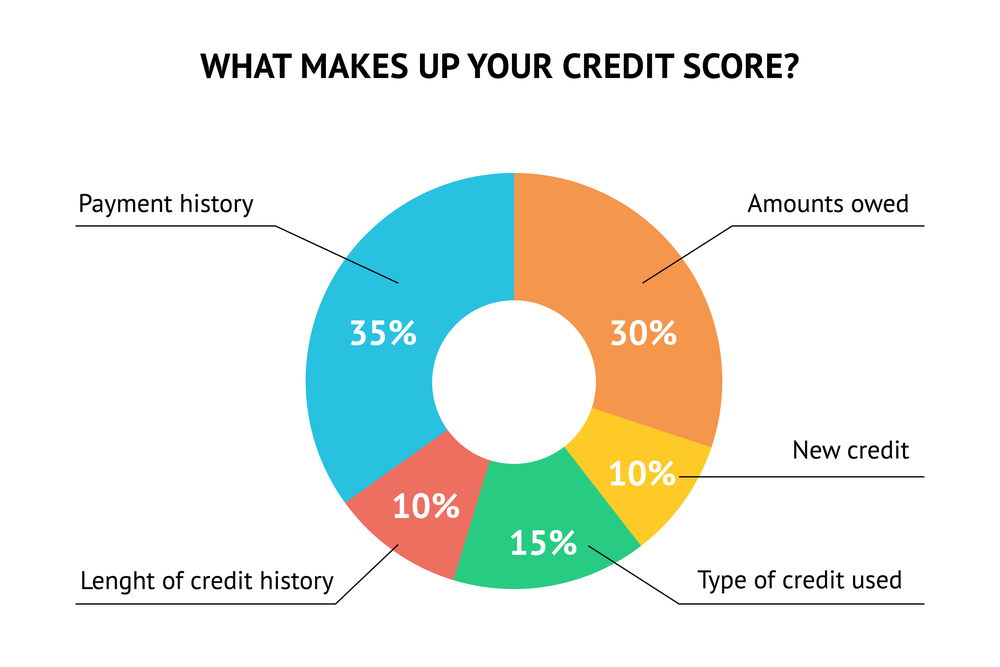

There’s no universal formula describing how a credit score should be calculated. In practice, the score is calculated based on a certain mathematical algorithm. There are several scoring models, one of the most common is the FICO score. In a nutshell, this is a metric frequently used by lenders to determine the consumer’s ability of paying the debt. For FICO reporting, the finite score is made up of your financial history, including bill paying frequency and owned debt records. In its most common form, the FICO score uses a 3-digit number ranging from 300 to 850 points. The average score must be around 700 (starting with 670, to be precise), which is considered good. The higher the score is, the more chances to get a loan at favorable interest rates. To calculate a finite credit rate, FICO considers the following:

- Credit history — a record of all payments, which constitutes 35% of the credit rating.

- Credit usage — the amount of the available credit you use (takes 30% of the FICO score). It’s recommended to stay between the 6-30%% rate, not lower, not higher.

- Credit history length – the period of time when your accounts were open (accounts for 15% of the credit rate). A longer history makes up for the better rating.

- Credit mix — a collection of credit accounts (totals up to 10% of the FICO score). However, even with a wide spectrum of accounts, you will hardly improve your finite credit rate.

- New credit — if you open several accounts or take several loans at once, the lender may consider your actions suspicious and reject further possible loan applications. The metric slightly influences your credit score, taking only 10% of the finite rate.

Even if your credibility is scored under a different model, the factors that impact your score are generally similar among models. Based on the earlier insights, now we can work out an action plan on improving the credit rate.

How to Raise the Credit Rate? Tips to Bear in Mind

Check your Score Online

The primary action for you is to check your credit rate with online credit rating tools. With it, you can see which factors affect your score and take the necessary measures. Spare some take for your actions to take effect and get reflected in your credit rate.

Pay Bills in Time

When evaluating your credit rating, lenders take the primary interest in your past payment performance, in particular, how regularly you pay bills. The advice here is straightforward: pay bills duly to compose a positive payment history. If you are dealing with multiple bills to settle, the tip is to automate payments or use reminders to make sure you pay them in due time. If you’re falling behind the schedule, pay the past-due bills asap. Although late payments continuously affect your credit rating, over time, this negative impact will be declining; mind that more recent payments have more weight than the older ones in defining your credit rate.

Keep the Credit Utilization Rate Low

The credit utilization ratio notably affects the finite credit rate. To calculate this ratio, add the total balance sum from all your credit cards you currently have and split it by the total credit limit. The ratio that equals 30% or less is considered positive by lenders. People with a good or even great credit rating have low ratios, which signifies lenders about their rational usage of credit without maxing out.

Don’t Apply Too Often

Although opening a new account may increase the total credit limit, the appeal itself may harm your credit history, if abused. As a result, too many credit inquiries will lower your rating, though it will recover over time (after two years at least).

Clarify Inaccuracies on your Credit Reports

Check the credit reports at all the main bureaus against inaccuracies. One can hardly underestimate the disastrous effect of inaccurate info on the credit rating, that’s why you should stay alert and be attentive. Make it a habit to monitor your credit’s correctness regularly.

Finally, How Long May It Take to Recover the Credit Rating?

With negative credit info, expect to wait for a while after paying bills. The duration of the waiting time depends on the severity of the case. Typically, bad scores result from past-due payments and excessive inquiries. While the former remains on the credit report for 7 years, the latter may stay there for up to a couple of years. Otherwise, the matter may be to build the credit score practically from the ground up, meaning that you have a small credit history, which is not enough for lenders to make a conclusion. If this is the case, you may ramp up your credit score by requesting a secured credit card or, say, applying for a credit-builder financing. At the end of the day, a good credit score can ensure you better loan terms, so it’s worth the effort.